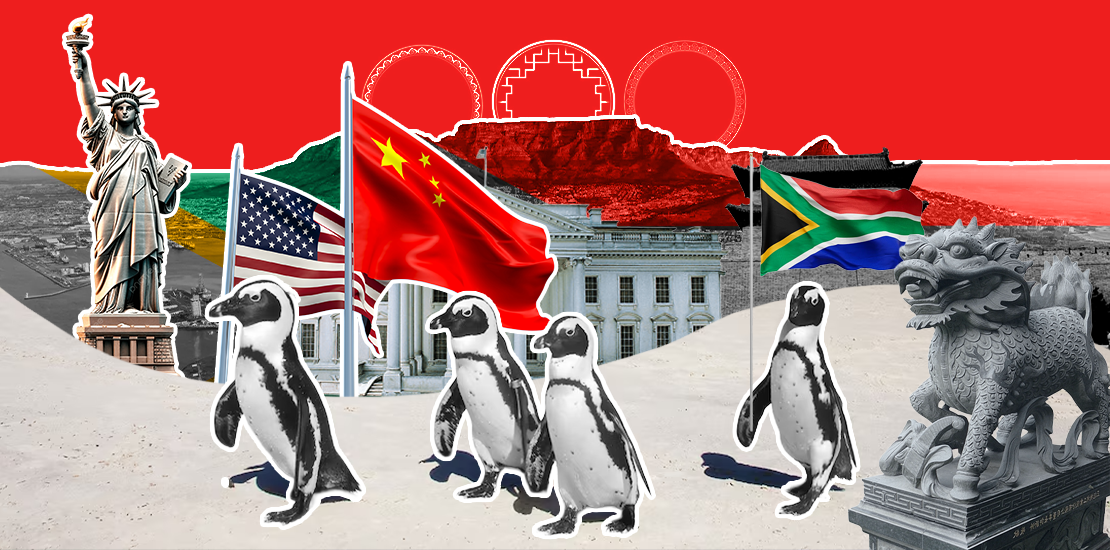

At the heart of the global energy transition, South Africa is no longer limited to exporting minerals. With major reserves of platinum group metals, manganese, and chromium, it supplies a decisive share of the metals needed for batteries, electric vehicles, and low- carbon technologies. In this context, the rivalry between China and the United States directly influences its industrial orientation and its integration into global value chains.

Since the early 2000s, China has established itself as Pretoria's key economic partner. Bilateral trade has increased more than thirtyfold, making Beijing the country's largest trading partner. Chinese investments cover industry, telecommunications, and infrastructure, with industrial and port areas geared towards exports. Officially, the two capitals refer to a "comprehensive strategic partnership" linked to the Belt and Road Initiative.

This presence serves a dual purpose. For Beijing, it is a matter of securing access to critical minerals while providing opportunities for its engineering, energy, and construction companies. For Pretoria, this capital makes it possible to finance long- awaited infrastructure and obtain commitments on industrial localization, particularly in the areas of electric vehicles, energy production, and metal processing. The authorities see this as a lever for moving upmarket, even if the debate remains open on the balance between local jobs, technology transfers, and the growing trade deficit.

The United States is approaching the issue from a perspective that is more focused on supply chain security. The US energy transition is increasing demand for platinum, manganese, and vanadium, areas in which South Africa occupies a dominant position. Washington is therefore seeking to diversify its sources outside China and secure long- term contracts with producers deemed reliable, combining economic diplomacy, financial instruments, and mining partnerships.

The most visible tool remains the African Growth and Opportunity Act (AGOA), which offers preferential access to the US market. South Africa is one of the main beneficiaries, particularly through the automotive sector, which exports several billion dollars worth of goods to the United States each year. This link gives Washington leverage: some officials have already raised the possibility of reviewing these benefits depending on Pretoria's diplomatic stance, pointing out that market access may be conditional on political affinities.

The Sino-American rivalry is thus reflected in cross-diplomatic pressure. China promotes South-South cooperation, supports South Africa's agenda within the BRICS, and values the country as a gateway to the continent. The United States insists on the "reliability" of its allies and the need for political convergence, particularly on international conflicts and global governance reform. Every public statement made by Pretoria on issue is interpreted as a sign of alignment with or distance from one camp or the other.

These tensions form the backdrop to a reorientation of South African industrial policy. The government has adopted a strategy dedicated to critical minerals and metals that identifies priority substances (platinum group metals, manganese, vanadium, copper, lithium, among others) and emphasizes local processing. The goal is to move from a model centered on the export of raw minerals to one based on refined metals and intermediate materials. It is part of a broader vision of green reindustrialization and the creation of skilled jobs.

This strategy is linked to other instruments: an automotive support plan, an electric vehicle roadmap, green hydrogen projects, and improvements to logistics corridors. It also involves sensitive trade-offs on mineral export conditions, the possible introduction of taxes to encourage local processing, and the definition of volumes reserved for certain industrial projects. Mining companies, both South African and foreign, are carefully examining these options, which could affect the profitability of investments and the structure of long-term contracts.

Between Beijing and Washington, Pretoria is seeking to turn rivalry into opportunity. On the industrial front, this translates into a strategy of diversifying partners: discussions with Asian manufacturers to attract electric vehicle factories, strengthening cooperation with the United States and the European Union to secure stable markets, and a declared willingness to develop more processing on African soil. The common thread is the search for technology transfers, local content, and skilled jobs, rather than extraction alone.

For South Africa, the central issue is therefore not to choose sides, but to preserve its ability to define its own development priorities. The China-US rivalry opens a window of opportunity for negotiation, but it also carries risks: the undermining of preferential trade regimes, volatility in capital flows, and fragmentation of technological standards. The credibility of industrial policy will depend on the clarity of the rules offered to investors and the state's ability to apply them in a predictable manner.

In the coming years, the extent to which Pretoria can use this rivalry to its advantage will depend on how it implements its strategy on critical minerals, how it balances the demands of its partners, and how it manages internal constraints. South Africa finds itself at a crossroads: remain a resource supplier in a game dominated by others, or assert itself as an industrial player capable of influencing the architecture of global energy transition value chains.

South Africa

South Africa

Ivory Coast

Ivory Coast

Algeria

Algeria

Democratic Republic of Congo

Democratic Republic of Congo

FR

FR

EN

EN